Azura-Edo IPP - Nigeria

The Azura-Edo IPP is a 461MW Open Cycle Gas Turbine power station, the first project initiated by Azura Power.

We focus on opportunities where we can add significant capacity to the national grid, developing gas-fired projects or those with the ability to convert to gas.

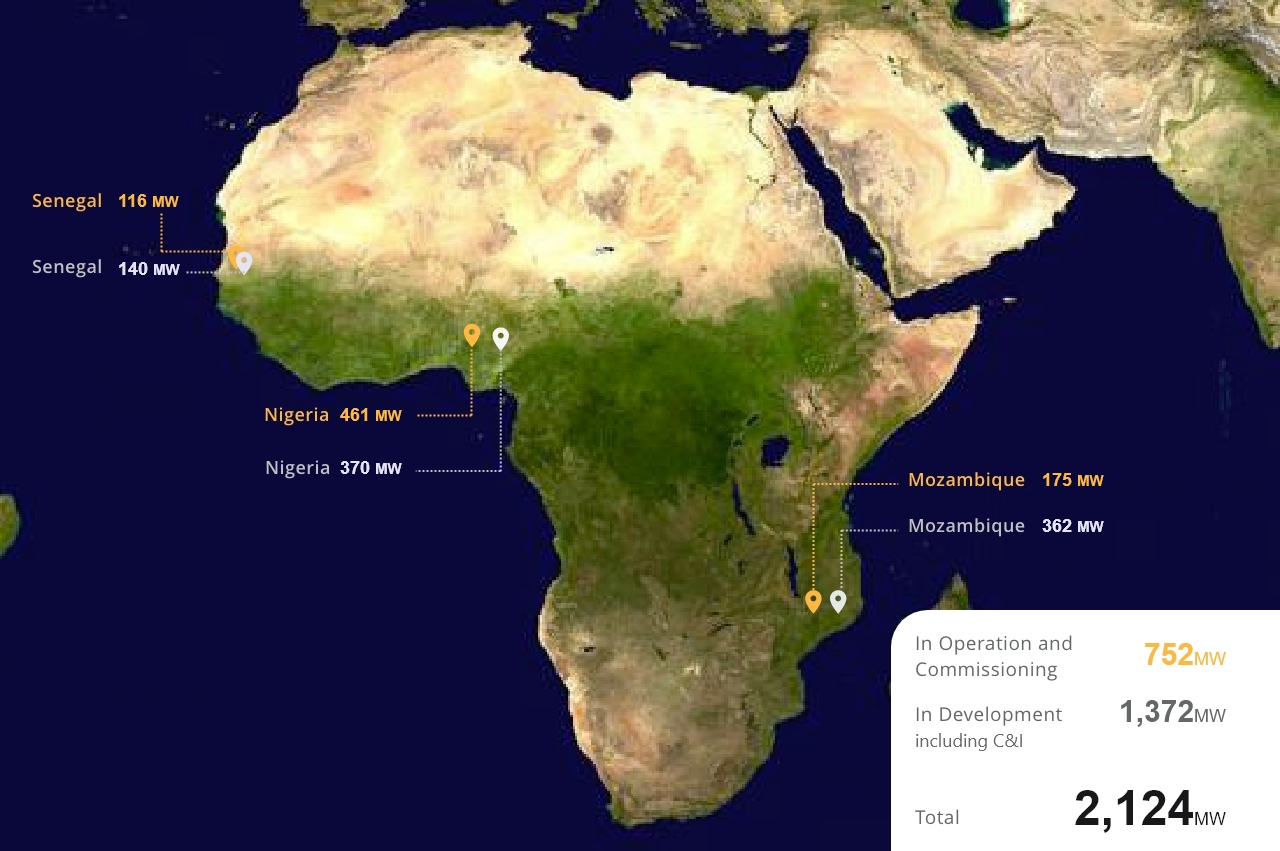

Our operating and in commissioning plants have a total capacity of 752MW, and our portfolio includes a further 1,372MW of generating capacity which is in development. Through the continued expansion and diversification of our portfolio, we are focused on building a pipeline of globally competitive development and acquisition opportunities.

We recognise the need to measure and optimise our impact. Strong ESG principles and practices lie at the heart of all decision-making and inform the design of every aspect of our business to ensure sustainability.

Gas provides a reliable, cost-effective source of fuel for the level of power generation required to drive industrial growth and create jobs at scale. In addition, our plants provide important ancillary services to the grid, including frequency response and black start, which are critical to grids in developing economies that are often unstable, or where there is significant renewable generation.

By providing robust offtake agreements, we support African Governments to develop indigenous gas resources, create high quality industrial infrastructure and boost energy access and independence. This reduces reliance on costly imports, mitigates vulnerability to price shocks and generates significant revenues for nations under pressure to serve fast-growing societies.

By driving the emergence of new technologies, we are developing Africa’s future energy solutions today.

Grid Capacity

752 MW

Jobs Created

333

Total Female Workforce

18%

The Azura-Edo IPP is a 461MW Open Cycle Gas Turbine power station, the first project initiated by Azura Power.

The 116MW Tobene Power plant in Senegal began operations in 2016. It is one of the most efficient plants on the Senegalese grid.

The 175MW gas fired CTRG project is our flagship project in Mozambique.

In Nigeria we are developing a 270MW expansion to Azura-Edo, while also developing Azura-Nova, our 100MW solar power plant on 200-hectare site in Katsina State, Nigeria.

We are currently working on converting Tobene to gas operations as as a potential expansion of the project. Separately we are developing other projects in country focused both on and off-grid.

In Mozambique we currently have 362MW of projects spread between gas and renewable developments as well as a potential expansion project.